Chosen theme: Best Practices for Bookkeeping in Malaysian Enterprises. From SST nuances to payroll postings and bank feeds, here’s a friendly, no-jargon roadmap to keep your books clean, compliant, and insightful. Stick around, share your challenges, and subscribe for fresh, Malaysia-focused tips every week.

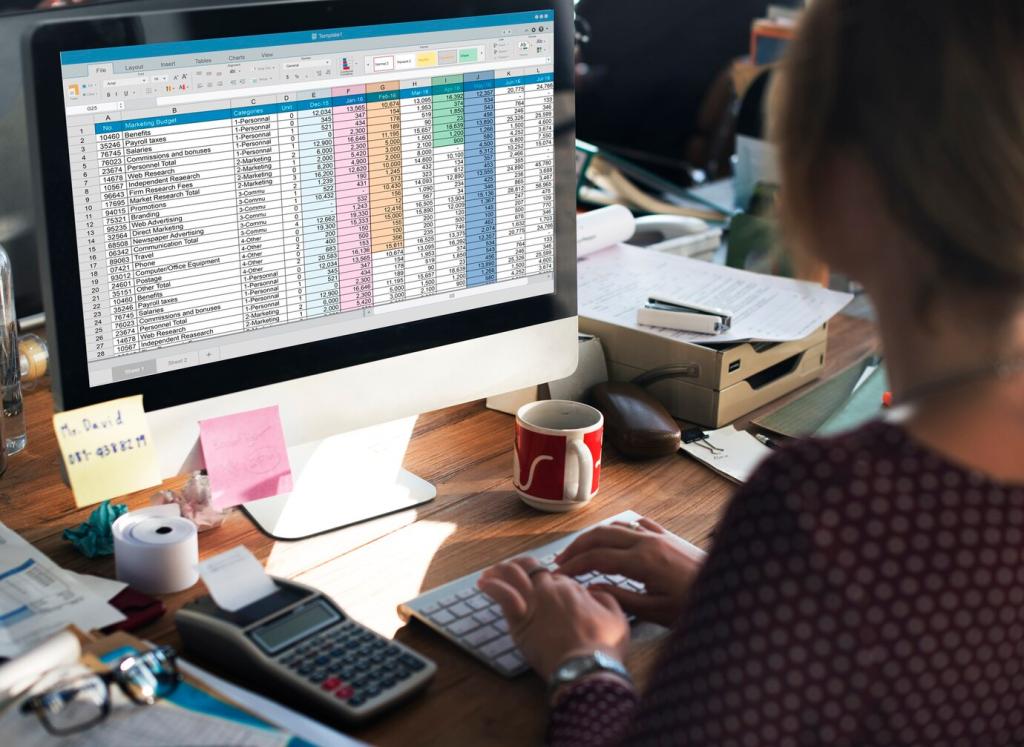

Design a Localized Chart of Accounts

Map for Malaysian realities

Create accounts for SST output and input, EPF, SOCSO, EIS, HRD levy, and PCB deductions. Separate director advances, staff claims, and e‑wallet floats. Clear labeling reduces coding mistakes and speeds reconciliations, especially when multiple team members book entries under tight month‑end deadlines.

Segment by business lines and grants

Track revenue, cost of sales, and operating costs by product line, state, or channel. Use project or tracking categories for government grants and incentives. This structure reveals which activities truly earn their keep and which are riding on the coattails of a top performer.

Prepare for multi‑currency and cross‑border

If you export or purchase in foreign currencies, enable currency‑specific bank accounts and revaluation processes. Capture realized and unrealized gains separately. Consistent treatment ensures your profit does not swing wildly just because rates moved, and stakeholders can trust comparative results.

Payroll Accounting and Statutory Contributions

Split gross wages, employer contributions, and employee deductions in your journals. Reconcile monthly against statutory submissions and bank transfers. A separate liability account for each scheme helps spot underpayments quickly, avoiding penalties and protecting employee trust when questions inevitably arise.

Payroll Accounting and Statutory Contributions

Plan for Potongan Cukai Bulanan, annual bonuses, and leave encashment with accruals booked throughout the year. Tie every payout to an approved schedule. This keeps expenses aligned with performance periods and prevents budget shocks that can strain morale and cash at quarter‑end.

Digital Documentation and e‑Invoicing Preparation

Ensure customer tax IDs, SST treatment, item descriptions, units, and discount logic are consistent. If e‑Invoicing timelines shift, your internal consistency should not. Clean, reliable master data is the difference between smooth automation and late‑night manual patchwork every month.

Digital Documentation and e‑Invoicing Preparation

Evaluate accounting systems like Xero, QuickBooks Online, SQL, or AutoCount alongside your POS and payroll. Look for API flexibility, local tax support, and robust audit logs. The best stack is the one your team can actually run without endless workarounds or brittle spreadsheets.

Internal Controls That Scale with SMEs

Segregation of duties, sensibly applied

Even in small teams, separate who raises a purchase, approves it, and pays it. Use maker‑checker principles for vendor changes. Lightweight controls, consistently enforced, prevent both innocent mistakes and intentional mischief without suffocating speed or creating theatrical bureaucracy.

Vendor onboarding and SST checks

Collect company details, bank verification, and SST registration status where relevant. Assign vendor categories and payment terms deliberately. Periodic reviews catch duplicates, dormant suppliers, or risky relationships. The payoff appears in cleaner ledgers and fewer awkward conversations later.

Data‑driven spot checks

Run exception reports for round‑number payments, weekend postings, and unusual tax codes. Surprise petty cash counts expose bad habits early. A little analytics, applied routinely, builds a culture where accuracy is normal and irregularities are addressed before becoming costly stories.

Close cadence and commentary

Set a reliable monthly close date and include a narrative explaining variances, one‑offs, and cash movements. Numbers answer what and when; commentary explains why. Leaders act faster when context arrives with the figures, not days later in separate emails.

KPIs that actually help

Track gross margin by product, Days Sales Outstanding, inventory turns, and operating cash flow. Avoid vanity ratios that do not drive decisions. A short, consistent dashboard beats an encyclopedic pack nobody reads or remembers by the next meeting.

Board‑ready packs without drama

Use a concise template: highlights, lowlights, actions, and forecast. Lock versions, cite sources, and maintain a definitions page. Your goal is trust—leaders should feel the numbers are dependable, repeatable, and free from surprises hidden in footnotes or last‑minute edits.

Johor manufacturer’s cash win

By mapping bank fees correctly and tightening receivables reminders, a mid‑size factory shaved nine days off its cash cycle. The books didn’t just look cleaner; purchasing could plan confidently, avoiding emergency financing and the stress that comes with it.

KL tech startup’s e‑Invoicing prep

A SaaS team standardized customer data, validated tax fields, and cleaned legacy invoices before implementation. When timelines shifted, they stayed calm because their foundations were solid. Their lesson: do the boring work early, and automation becomes a welcome passenger.

Penang café group’s stock sanity

Weekly stock counts and recipe costing revealed silent margin killers—spoilage and portion drift. After adjusting procedures and retraining staff, gross margin rose steadily. Bookkeeping wasn’t just compliance; it became the lens that made operational fixes obvious and urgent.