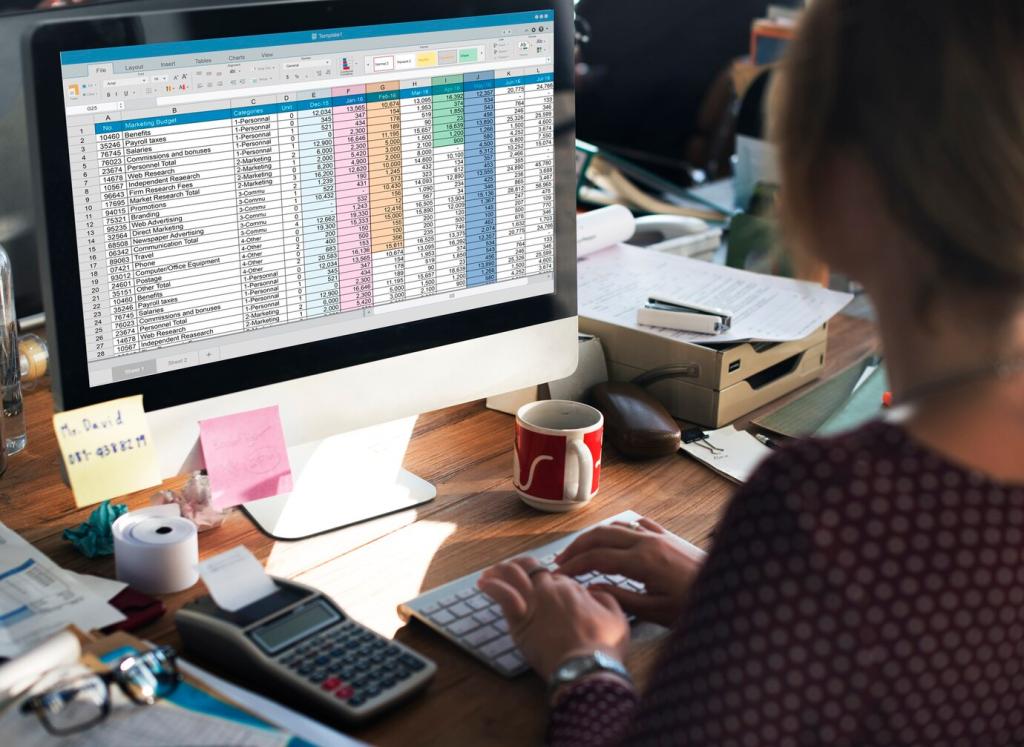

Setting Up a Malaysia‑Ready Chart of Accounts

Design revenue accounts that separate taxable and non‑taxable services, SST‑exempt items, and export sales. If you run mixed activities, tag each line with clear tax codes. This clarity simplifies MySST filings and prevents accidental overcollection or undercollection when service tax rates or scopes shift.

Setting Up a Malaysia‑Ready Chart of Accounts

Create expense groups for advertising, staff welfare, utilities, and professional fees, then flag partially deductible categories like entertainment. Distinguish repairs from capital improvements to support capital allowance claims. Thoughtful labeling now saves hours when your tax agent asks for specific schedules and supporting documents.