People and Payroll: Get It Right, Every Month

Document rates and processes for EPF, SOCSO, EIS, and PCB, and monitor regulatory updates proactively. Automate calculations where possible, and calendarise payment deadlines to avoid costly penalties. Keep signed forms and payslips securely. New hires and leavers deserve extra attention to ensure complete and compliant records every single time.

People and Payroll: Get It Right, Every Month

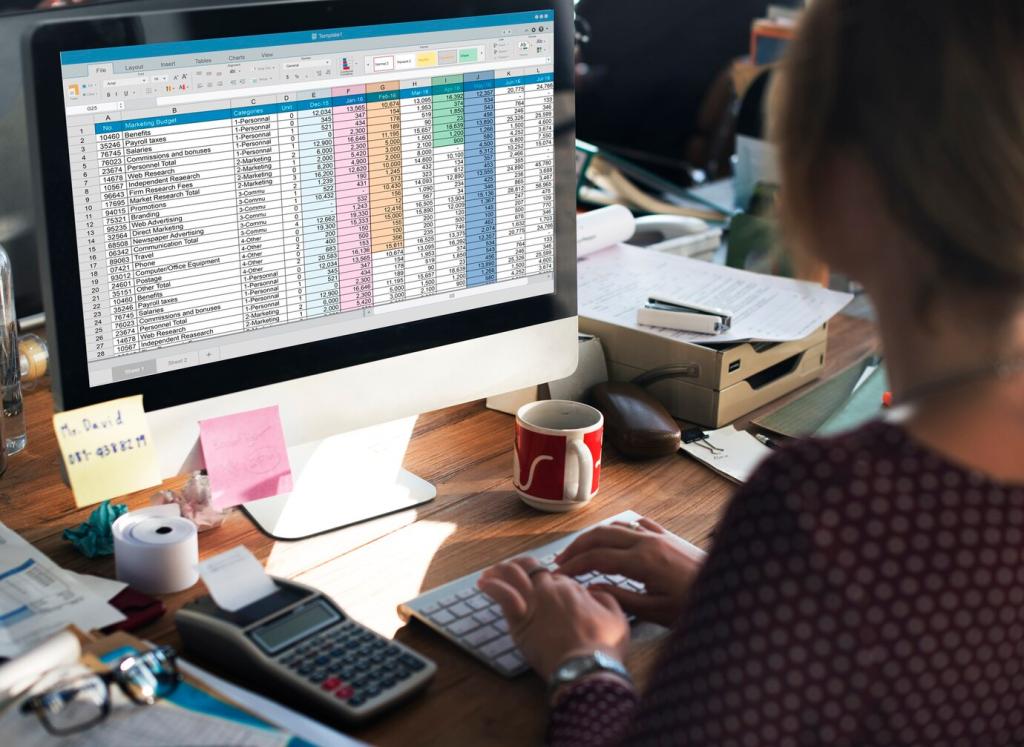

Post monthly journals with clear splits by department or outlet, matching gross wages, statutory contributions, and accruals for bonuses. Reconcile payroll control accounts during every close. This visibility helps managers understand labour as a controllable cost, not a mystery. Ask for our sample payroll journal template to get started quickly.