Chosen theme: Overcoming Bookkeeping Challenges in Malaysia. Welcome to a practical, people-first guide that blends local regulations, lived experience, and simple frameworks so Malaysian founders, finance leads, and solo bookkeepers can stay compliant, confident, and ready for growth. Subscribe for fresh, locally grounded tips and real stories every week.

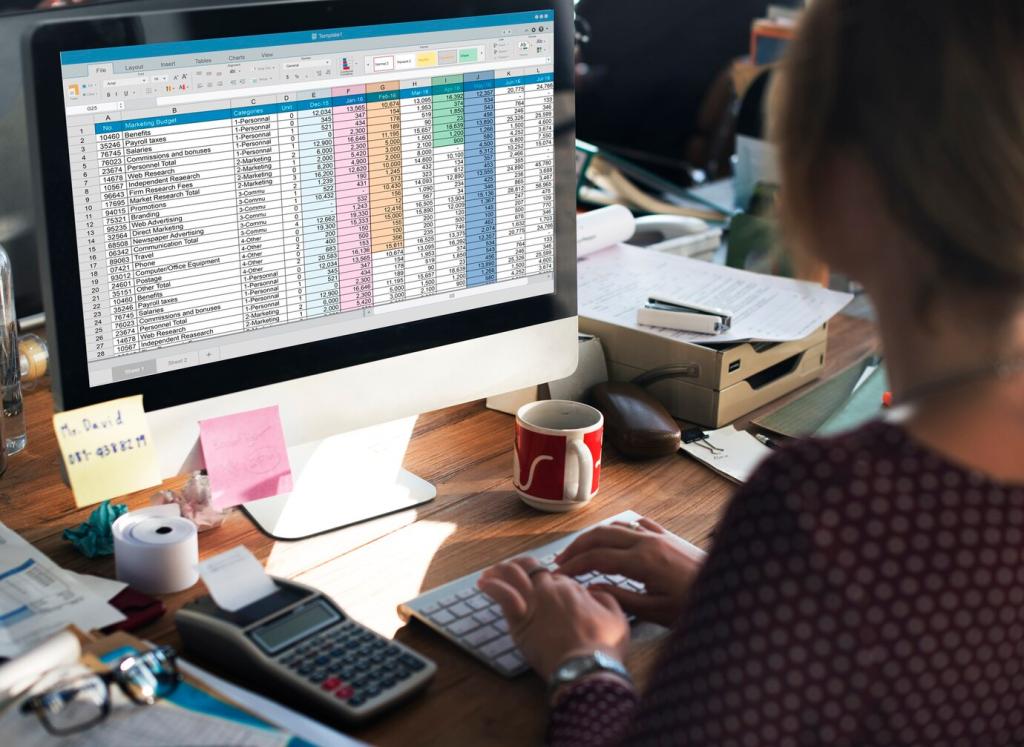

LHDN essentials and audit triggers

Keep books accurate, organized, and consistent, because LHDN looks for gaps in documentation, mismatched figures, and unexplained cash movements. A reader from Ipoh told us their stress vanished after creating a simple audit file index and monthly variance notes. Ask us questions and we’ll help refine yours.

SST in practice: classifications and filings

SST remains a frequent sticking point. Understand whether you’re in scope, apply the right categories, and reconcile bi-monthly filings to your general ledger. One KL café avoided penalties by mapping sales categories carefully and capturing service charges separately. Share your SST pain points below so we can publish targeted checklists.

E-invoicing rollout: timeline and readiness

Malaysia’s phased e-invoicing begins with large taxpayers and expands progressively through 2027. Start early: standardize invoice data, test integrations, and document exception handling. A Penang electronics SME ran a mock month and uncovered address-format issues early. Comment if you want our readiness template tailored to your systems.

Systems That Actually Fit Malaysian SMEs

Pick cloud accounting that handles SST, e-invoice data fields, and Malaysia-specific tax mappings. Test how credit notes, advances, and rounding flow into reports. One startup in Cyberjaya switched after discovering no SST reporting in their previous tool. Tell us your stack and we’ll suggest practical configurations.

Systems That Actually Fit Malaysian SMEs

Automate bank feeds where possible with Maybank, CIMB, or RHB, and set clear rules for references like GIRO codes and DuitNow identifiers. A Johor Bahru wholesaler cut reconciliation time in half by standardizing payment narratives. Share your trickiest bank statement quirks and we’ll crowdsource solutions.

Cash Flow Clarity in a Multi-Currency Reality

Define a consistent policy: use Bank Negara Malaysia’s reference rate on transaction dates, and revalue monthly. A Sarawak exporter avoided messy gains and losses by documenting the approach in their manual. Ask for our policy template if you’re unsure where to start, and we’ll send it to subscribers.

Cash Flow Clarity in a Multi-Currency Reality

Decide when to recognize revenue, how to treat deposits, and how SST applies to your specific goods or services. A SaaS founder in KL split invoices into service and reimbursable items to stay clear. Share your edge cases, and we’ll feature an explainer with anonymized examples in our next post.

People, Processes, and Training that Scale

Create a 5–7 day close calendar: bank recs day two, AR aging day three, accruals day four, management review day five. A Melaka distributor posts a one-page dashboard each month. If you want our sample close checklist tuned for Malaysia, say “close” in the comments and subscribe.

People, Processes, and Training that Scale

Standardize claims with receipt requirements, merchant names, and GST-era legacy receipt handling, plus Touch ’n Go and e-wallet exports. A Kota Kinabalu team reduced disputes by adopting simple per-diem rules. Tell us your e-wallet workflows and we’ll share a tagging system that auditors love.