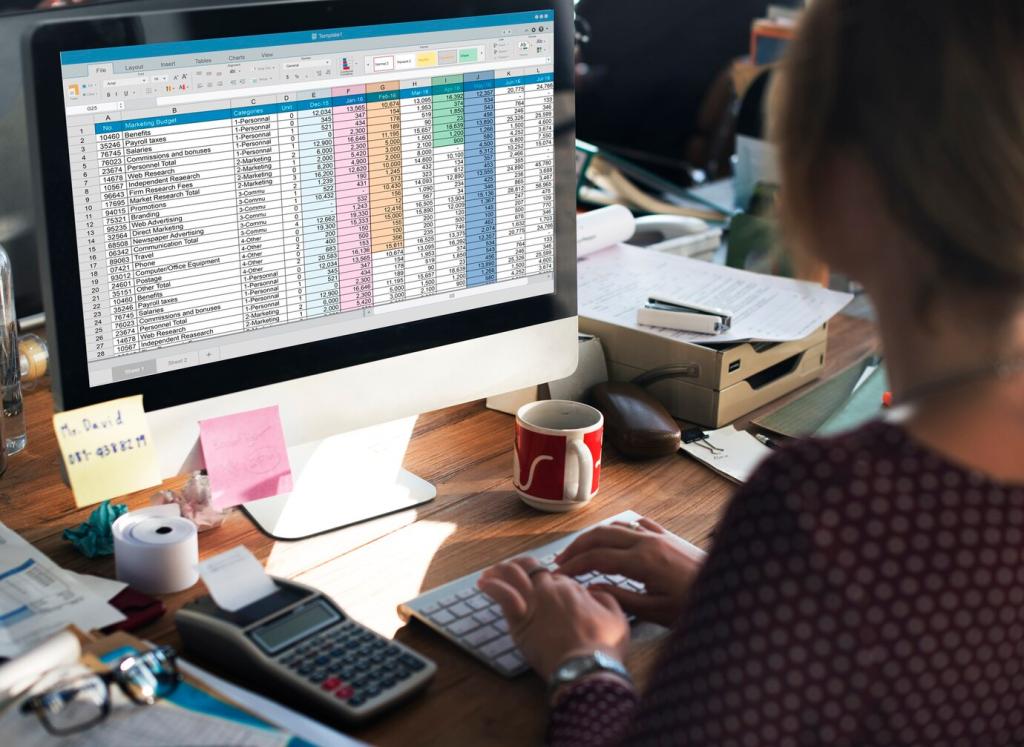

Automation and Integrations That Save Hours

Reliable, categorized bank feeds with rule-based matching can cut your month-end crunch in half. Flags for duplicates and partial payments keep your ledger clean. If your team still manually pastes statement lines, it is time to upgrade. Share your reconciliation time-savers—others will thank you.

Automation and Integrations That Save Hours

Integrations with Shopify, WooCommerce, Lazada, Shopee, or POS systems like StoreHub streamline settlement breakdowns and fees. The best tools map payouts, refunds, and taxes to the right accounts every time. Ready to reduce channel confusion? Tell us which marketplace gives you the biggest reconciliation headaches.